We provide ongoing support for your project(s)

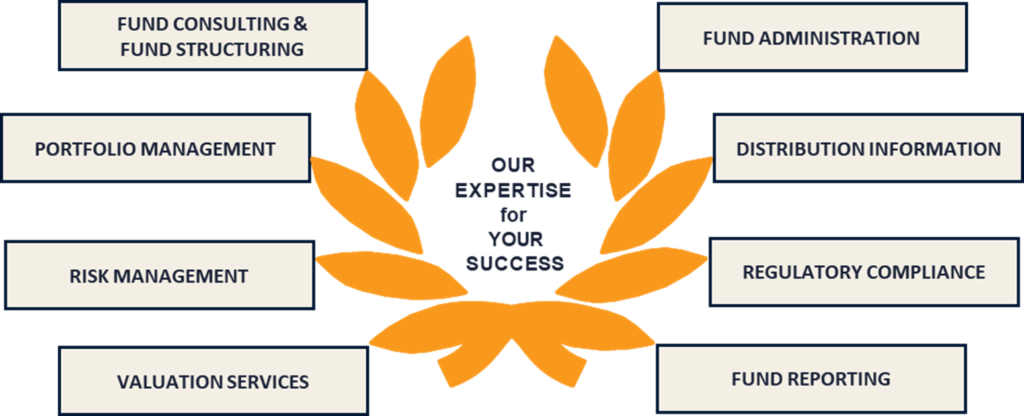

We help you with all ongoing tasks that are required under the law. Besides the overall setup provcedure for investment funds we continue to serve you with tasks of overall administration, portfolio management, risk management and distribution. While some of these tasks may be delegated to you, we shall ensure that all tasks are at all times clearly allocated to responsible parties.

In the area of administration, for example:

- Booking and valuation of all the fund’s positions as at each NAV calculation (independently of the depositary)

- Periodic calculation of the NAV within the prescribed time limits once all the information required for the calculation(s) are available

- Verification of all fund transactions with regard to execution prices, conditions, etc.

- Processing of all fund transactions and other events involving securities

- Overall book-keeping for the fund (and separately for the investment companies accounts, if any)

- Production of settlements for issue commissions, management fees and performance fees (usually once per quarter)

- Drafting and publication of the annual and semi-annual reports and of all other reports as required by law

- Monitoring of investment restrictions and performance of regulatory risk management

- Provision of information to data suppliers, investment fund platforms and the press where required

- Contacts with all Liechtenstein authorities as and when required

In the area of portfolio management, for example:

- Investment of the fund’s assets in line with the constitutive documents of the fund

- Continuous documentation and monitoring of the fund’s assets

- Acting as an interface with external (delegated) portfolio managers

In the area of risk management, for example:

- Analysis of funding risk, liquidity risk

- Quantitative and qualitative regulatory risk reports

- Acting as an interface with external risk managers

In the area of distribution, for example:

- Co-operation agreements with third parties

- Appointment of representatives and paying agents in e.g. Switzerland

- Acting as an interface with external distribution partners

In the area of further operational services (optional), for example:

- individual portfolio management

- auditing

- accounting

- Trust services

- Family foundations

If you are interested in any such additional services, please contact us in person as we may be offering such complimentary services via our shareholders.

Services provided independently by the chosen depositary bank:

The depositary function as prescribed by law may only be performed by a bank domiciled in Liechtenstein. The right to employ sub-depositaries or work with prime brokers is reserved.

Usually, the core services of the depositary are:

- Subscription and redemption of fund units

- Safekeeping (custody) of the unit certificates and the fund’s assets

- Keeping the unit register

- Carrying out due diligence

- Monitoring the fund’s investment guidelines

- Execution and regulatory control of all the fund’s payment transactions

- Purchase and sale of all target investments (execution)

- Execution and monitoring of all settlements (corporate actions)

- Verification of the appropriation of profit

- Independent computation / plausibility-testing of the net asset value (NAV)

- Plausibility-testing of investors (in line with statutory requirements)

- Examination of initial constitutive documents of the fund

Services provided by the external certified auditor

- Examination of the initial constitutive documents of the fund

- Ongoing audit of the fund and of any associated publications

- Best-practice recommendations

Potential partners include BDO / PWC / E&Y / Grant Thornton AG and various others

Liechtenstein FMA

- Authorisation and/or approval of the investment funds

- Continuous supervision of the fund management companies, the depositaries, the appointed certified auditors and the investment funds managed

Services provided by any (additional) external service providers

- Tax consultancy

- Independent expert opinions, e.g. when valueing private equity or real estate

- Establishment of (holding) companies, e.g. with a view to more efficient management of equity interests and/or better cash flow management within the fund structure

- Assumption of governing officer functions (e.g. in holding companies)